Ingest Data from Other Systems

This guide explains how Ledgers can be used to unify financial data across your product or platform.

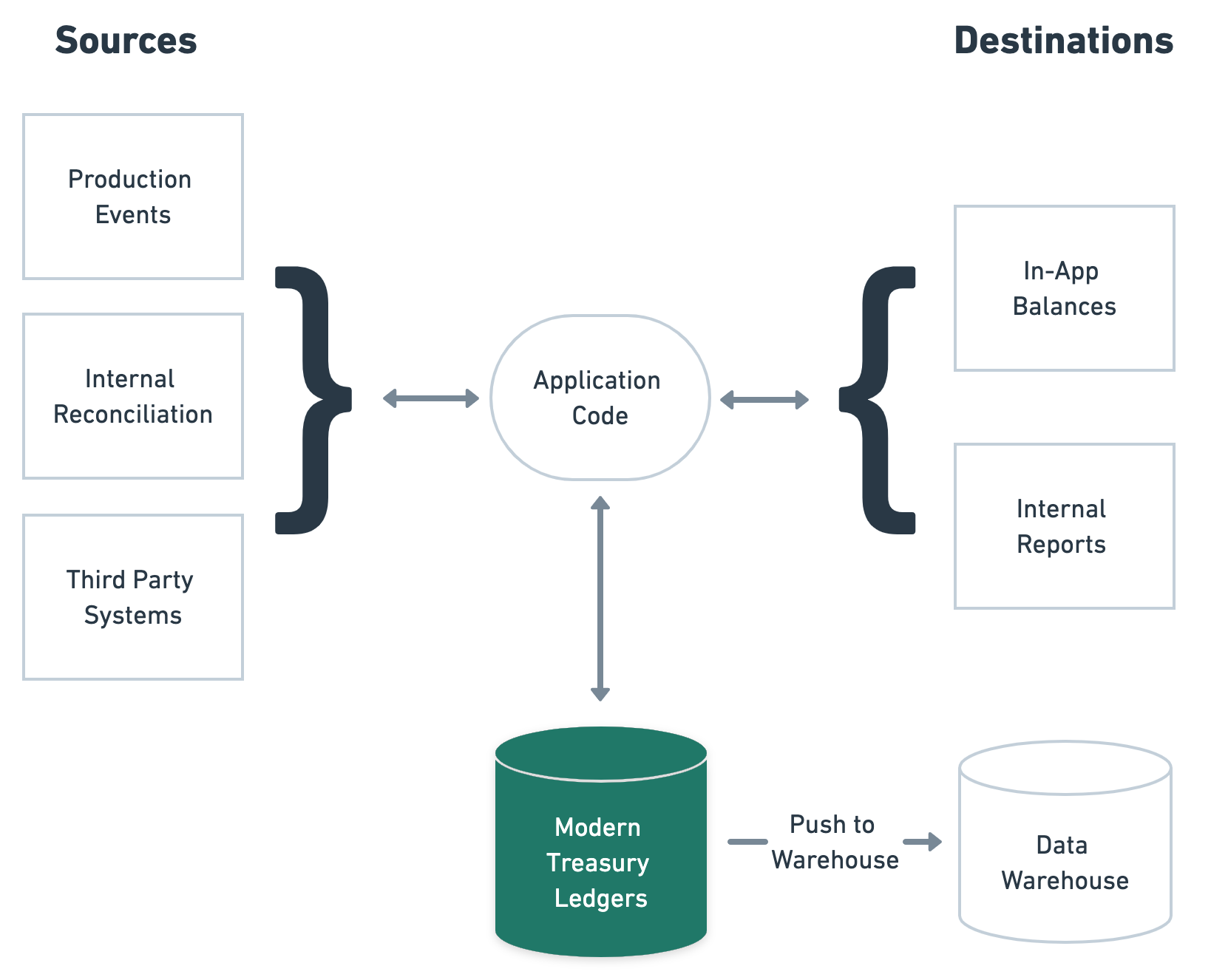

Ledgers works as a central database for financial transactions. You can write transaction data originating from multiple sources into Ledgers. The system will make that data available for use in production and internal reports. This guide covers common data sources and destinations for the data stored in Ledgers.

Sources

Ledgers acts as an agnostic source of truth for financial information in your data stack. Companies use Ledgers to centralize data from production events, third-party systems, and internal processes via API or web app.

Production Events

Business events are captured by your production environment continuously. If they impact the money flowing through your product or platform, they can be captured on Ledgers. Such events typically fall into one of two categories:

- Payments: incoming or outgoing funds transfers via any payment rail (cards, ACH, wire, etc.) and in any currency.

- Ledger entries: adjustments on previous entries, in-ledger transfers (from one account to another without actual movement of money), or internal processes that trigger balance changes (such as interest calculation on an outstanding loan).

Your application logic will handle such events and write them into the ledger using the create ledger transaction endpoint.

Third Party Systems

As a source agnostic database, customers typically log transaction data onto the ledger from:

- Card Issuing APIs such as Lithic or Marqeta. Ledgers can execute read and write requests based on the response returned from these partner APIs. A common use case is checking a balance on Ledgers before authorizing a purchase.

- Payment processors such as Stripe or Adyen. Ledgers can be used to log transactions for audit purposes, tally up card payments against relevant account balances and seamlessly make transaction data available to the destinations listed below. This is particularly helpful for businesses that work with multiple payment processors.

- Vertical payment platforms such as loan management tools (Peach or LoanPro) or insurance claim management tools. Payments initiated or received via these systems can be consolidated into Ledgers. This is helpful for customers that want to use Ledgers as an independent data store that unifies disparate transaction sources.

- ERPs such as NetSuite, Workday, or Quickbooks. Payments initiated or received through these systems can be written in the ledger post-fact or as they happen. Given Ledgers is designed as a high-throughput data store, it can hold balance or transaction data that would otherwise be too granular for a general ledger.

- Invoicing platforms such as ChargeBee or Bill.com. Ledgers can log transactions associated with invoice objects from other systems, which is helpful if there are multiple invoicing systems in use or if data needs to be aggregated across systems.

These are just some of the common integrations Ledgers customers build. The create ledger transaction endpoint is flexible enough to write data on the ledger according to any pre-defined logic. Your application code defines how to handle business events from other sources, and Ledgers acts as the clean-slate real-time source of truth.

Ledgers seamlessly ingests transactions initiated by Modern Treasury Payments. Learn more on our Linking to Other Modern Treasury Objects guide.

Ledger Databases vs General LedgersAs opposed to a general ledger, Modern Treasury Ledgers is not designed to log all your business activity. Ledgers instead works as a high-performing database for financial transactions that are core to your product or platform experience. It's designed to work in tandem with and roll up information into your ERP or accounting software of choice. For more information, check out our article on the difference between a general ledger and a financial ledger database.

Internal Processes

In addition to product or platform-level triggers, business teams can write information into the ledger via the API and the web app. The most common situation for this is in the case of accounting reconciliation processes. Adjustments on the Ledger can be made by way of modifying entries.

Destinations

As a central source of truth, Ledgers can be used to expose financial data to internal and external stakeholders.

In-App Balances

A common use case for Ledgers is using account balances as digital wallets. We typically see this in:

- Companies that hold a balance for users as part of their core offering (e.g. peer-to-peer payment apps, lending, insurance, or investment platforms).

- Companies that want to expand their offering by attaching a digital wallet functionality in any currency (including crypto, rewards, and points) to their product or platform. This can be particularly useful to marketplaces and vertical SaaS companies.

Customers use the Ledgers API to accurately expose balances to their end users at all times: as events are written into the ledger, balances are updated automatically.

Internal Reports

Transaction data stored on Ledgers can be used for decisioning purposes. We commonly see that in the case of:

- Payouts. As a high-performing database, Ledgers consistently updates balances according to business events and provides a trustworthy and accurate data source for making payout decisions. This can be particularly helpful to marketplaces, investment firms, and fintechs.

- Reconciliation and accounting support. Ledgers acts as a source of truth for payment data in production. Such data can be helpful when reconciling past transactions and balances with bank records for accounting purposes.

- Resolving customer issues. Given that Ledgers keeps a complete log of transactions at all times, the database can be used to support customer queries related to historical transactions and balances.

- Audits. Ledgers holds full information about transaction history down to the API call level. Audit logs can be used to generate reports useful to auditors.

- Reporting. Because Ledgers holds an aggregate view of the flow of money in your platform, you can use the API to report on balances and transaction trends over time. This can be helpful in deriving relevant financial information such as cash burn, transaction volume, or liabilities.

Internal reports can be constructed using the API, CSV exports from the Ledgers web app, as well as Push to Warehouse (see more below).

Push to Warehouse

Finally, Modern Treasury Ledgers features a Push to Warehouse feature that allows you to export Ledgers data into your data warehouse of choice (including AWS Redshift, PostgreSQL, Google BigQuery, and Snowflake), making it available for manipulation with analytics tools like Tableau or Looker. Data is updated via hourly or daily transfers.

Push to Warehouse allows you to run complex queries on Ledgers data without relying on CSV exports or high-volume API querying.

Next Steps

Ledgers was designed to act as the central source of truth for transactions and balances in your platform. For more information:

- Review our Guide to Debits and Credits to understand the accounting principles behind Ledgers

- Explore use cases with Use Case Guides

Updated 3 months ago